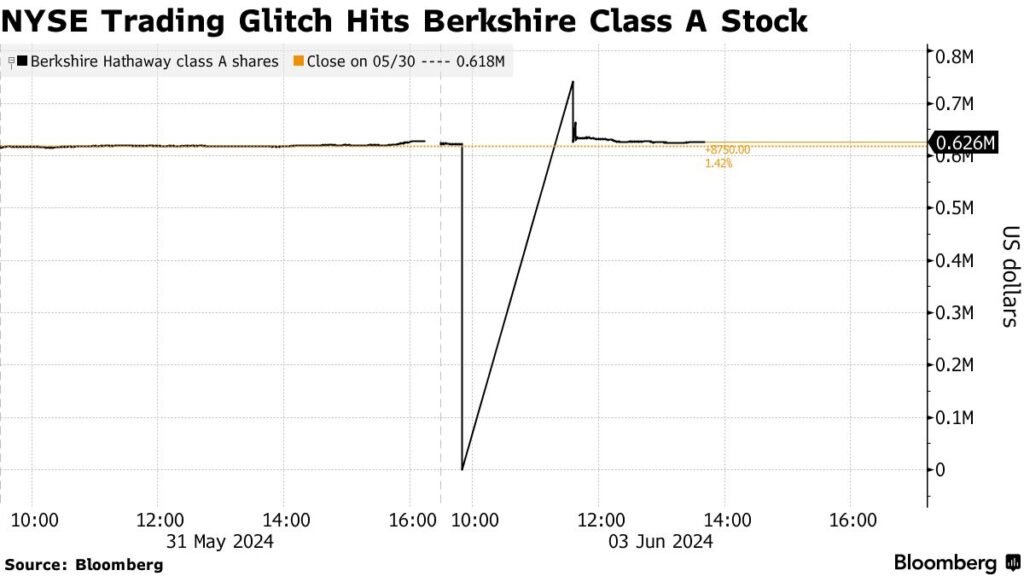

A technical glitch at the New York Stock Exchange on June 3, 2024 caused significant disruptions, with several stocks, including Warren Buffett’s Berkshire Hathaway, appearing to plummet by as much as 99%. The NYSE halted trading in the affected stocks and worked to resolve the issue, which stemmed from a problem with the exchange’s price band system.

Accident Details

- The NYSE glitch on June 3, 2024, led to erroneous price displays and volatility halts for several securities, with Berkshire Hathaway A-shares (BRK-A) showing a drastic 99.9% price decrease from $627,400 to $185.10.

- Berkshire Hathaway B-shares (BRK-B), which trade at 1/1,500th the price of A-shares, experienced a more modest decrease of up to 1.1% and exhibited heightened volatility.

- This technical issue followed closely on the heels of an incident last week where live calculations for the S&P 500 and Dow Jones Industrial Average were unavailable for approximately an hour.

- The NYSE had recently initiated one-day settlements for stocks to adhere to a new SEC rule, which had previously mandated a two-day timeframe between a trade and settlement

Cause: CTA SIP Issue

The NYSE glitch was caused by a technical problem with the industry-wide price bands published by the CTA SIP, which are designed to prevent excessive volatility or extreme price movements for individual stocks. The issue led to the startling misrepresentation of stock prices on the exchange’s screens, with Warren Buffett’s Berkshire Hathaway A-class shares momentarily plunging by nearly 100%. The NYSE reported that the problem had been rectified and the affected stocks had either reopened or were in the process of doing so.

NYSE Response and Trade Unwind

The NYSE swiftly responded to the technical glitch by halting trading in the affected stocks and issuing a statement confirming that the issue had been resolved, with trading resuming around 11:35 a.m. Eastern Time. To mitigate the impact of the erroneous prices, the NYSE announced that it would unwind trades made during the period of the glitch, effectively reversing any transactions executed at the incorrect prices. This decisive action helped restore normal trading conditions and maintain the integrity of the market.

Other Affected Companies

In addition to Berkshire Hathaway, several other companies were impacted by the NYSE technical glitch on June 3, 2024:

- Chipotle Mexican Grill (CMG), Horace Mann Educators (HMN), and Franco-Nevada Corp (FNV), a gold-focused royalty and streaming company, were temporarily halted due to the issue.

- The glitch instigated trading halts for approximately a dozen companies in total, causing confusion and volatility in the market until the NYSE resolved the problem.