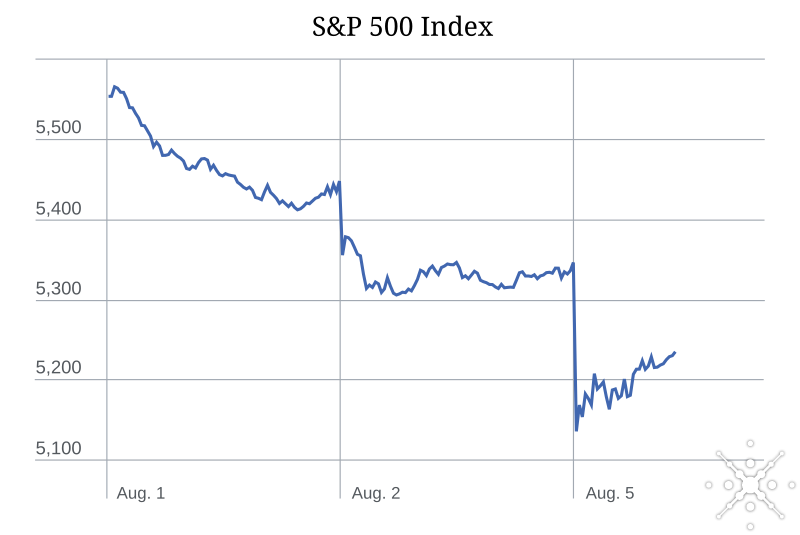

As reported by Reuters and Bloomberg, global stock markets experienced a significant sell-off on August 5, 2024, with investors fleeing to the safety of bonds amid growing concerns about a potential U.S. recession and the Federal Reserve’s policy stance.

Key Factors of Sell-Off

en.wikipedia.org

The global stock market sell-off in August 2024 was driven by several key factors that contributed to investor anxiety and market volatility. Here’s a list of the main drivers behind the sell-off:

- Weak U.S. employment data: The July jobs report showed U.S. employers slowed their hiring much more than economists expected, raising concerns about the health of the labor market.

- Poor corporate earnings: Worrying earnings reports from major tech companies like Amazon and Intel added to fears of an economic slowdown.

- Japan’s surprise rate hike: The Bank of Japan unexpectedly raised interest rates by 15 basis points, leading to an unwind of the popular Yen carry trade and accelerating stock market losses.

- Recession fears: The combination of weak economic data and poor corporate performance intensified concerns about a potential U.S. recession.

- Federal Reserve policy concerns: Investors worried that the Fed might be behind the curve in providing policy support for a slowing U.S. economy.

- Global market contagion: The sell-off that began in the U.S. quickly spread to other markets, with Japan’s Nikkei 225 experiencing its worst decline since 1987.

- Geopolitical tensions: Worries about potential escalation in the Israel-Hamas conflict and other global hotspots added to market uncertainty.

- U.S. election cycle: The upcoming U.S. elections were seen as a potential source of further market volatility.

- Berkshire Hathaway’s moves: Warren Buffett’s conglomerate reported cutting its massive Apple stake by about 50% and holding a record $277 billion in cash, which some interpreted as a bearish signal.

- Cryptocurrency decline: Bitcoin tumbled 19% since the previous Friday, crashing below $50,000 and indicating a broader risk-off sentiment in markets.

These factors combined to create a perfect storm of negative sentiment, leading to significant declines across global stock markets and other asset classes.

Global Market Reactions

Stock markets worldwide experienced severe declines, with Japan’s Nikkei 225 plummeting 12.4%, its worst day since the 1987 Black Monday crash. South Korea’s Kospi index fell 8.8%, while European markets sank roughly 3%. In the U.S., the Dow Jones Industrial Average dropped nearly 1,000 points, its worst fall since 2022, while the Nasdaq composite slid 3.8% in early trading. The sell-off extended beyond equities, with bitcoin tumbling 12% and even gold, typically considered a safe-haven asset, slipping 1.6%.

Federal Reserve’s Response

Speculation grew that the Federal Reserve might need to intervene with rate cuts sooner than planned, potentially before its next scheduled decision on September 18, 2024. However, some analysts, like Brian Jacobsen from Annex Wealth Management, argued that an inter-meeting cut was unlikely, stating that such measures are usually reserved for emergencies. The yield on the two-year Treasury, which closely tracks Fed expectations, fell to 3.79% from 3.88%, reflecting market anticipation of potential policy shifts. As an alternative to rate cuts, the Fed could consider halting the reduction of its bond holdings to alleviate pressure on longer-term yields.

Economic Uncertainty

Amid the market turmoil, concerns about a potential U.S. economic recession intensified. The S&P 500 experienced its worst week in over three months, dropping 4% in early trading on August 5, 2024. Despite these worries, some analysts maintained that the U.S. economy was still growing and a recession was not inevitable. The situation highlighted the delicate balance the Federal Reserve has been trying to maintain since March 2022, as it attempts to curb inflation without stifling economic growth. This economic uncertainty was further compounded by external factors, including potential escalations in global conflicts and the upcoming U.S. elections, which could introduce additional volatility to the markets.

Source: Perplexity