The company’s Data Center segment led the growth with a 111% jump to $30.8 billion compared to the previous year. Gaming, Professional Visualization, and Automotive segments also recorded increases of 14%, 16%, and 72%, respectively.

Nvidia’s stock prices have also increased by nearly 30% throughout Q3, and nearly 200% this year. The company’s performance is likely driven by the surging demand for Bitcoin mining and AI.

“The age of AI is in full steam, propelling a global shift to NVIDIA computing,” founder and CEO Jensen Huang noted in a press release.

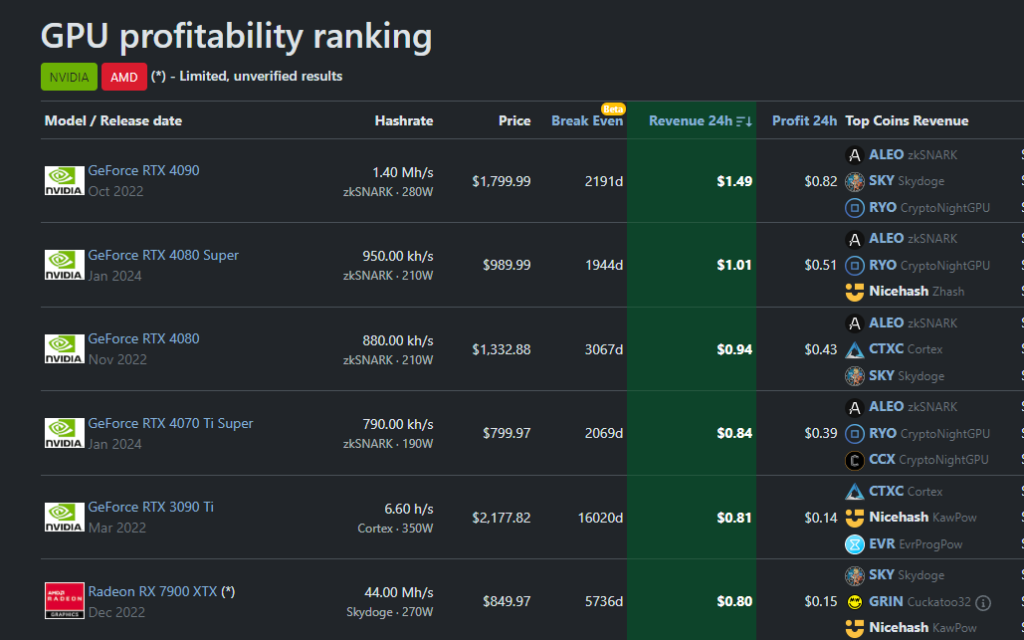

Also, the company has continued to dominate the GPU mining market. According to the latest data, its RTX hardware has consecutively outperformed any other products in the market in terms of GPU mining profitability.

Exploring Other Business Avenues

Amidst its surging revenue, Nvidia has been looking into new business avenues throughout the year. The company is venturing into humanoid robotics. The development aims to equip developers with tools to train robots using data from human demonstrations.

Earlier this year, Nvidia’s market capitalization surpassed the combined value of all Russell 2000 stocks by $10 billion, accounting for 43% of the S&P 500’s gains.

However, the company is facing regulatory challenges due to its strong association with crypto mining. In September, the Department of Justice (DOJ) issued a subpoena as part of an antitrust investigation.

The case is reportedly looking into whether Nvidia’s practices limit competition in sectors like crypto and AI.

Most recently, the Supreme Court indicated that it may issue a narrow ruling in a shareholder lawsuit. The lawsuit accuses Nvidia of misrepresenting its dependence on crypto mining revenue to investors.

Source: Be (in) Crypto