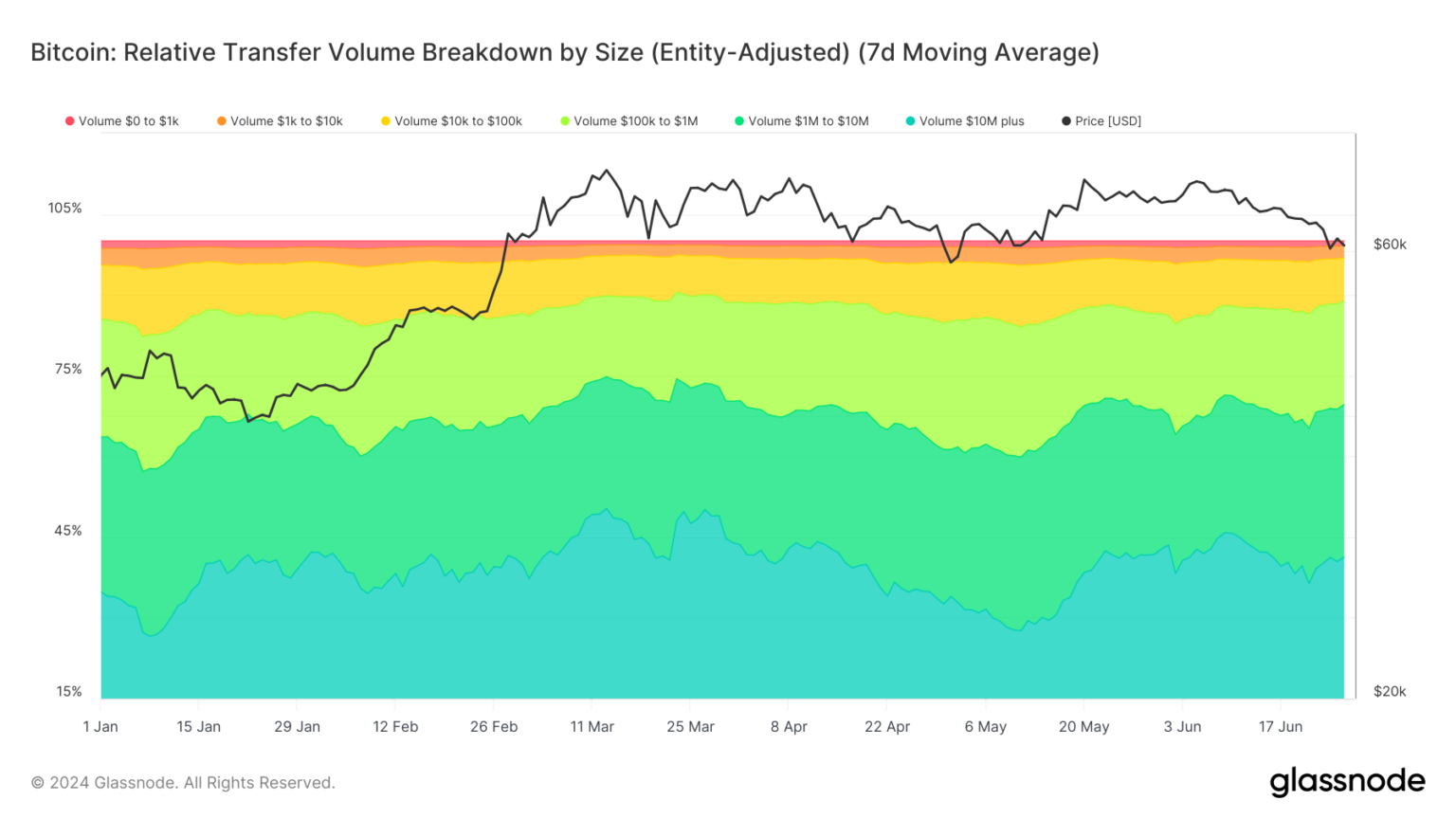

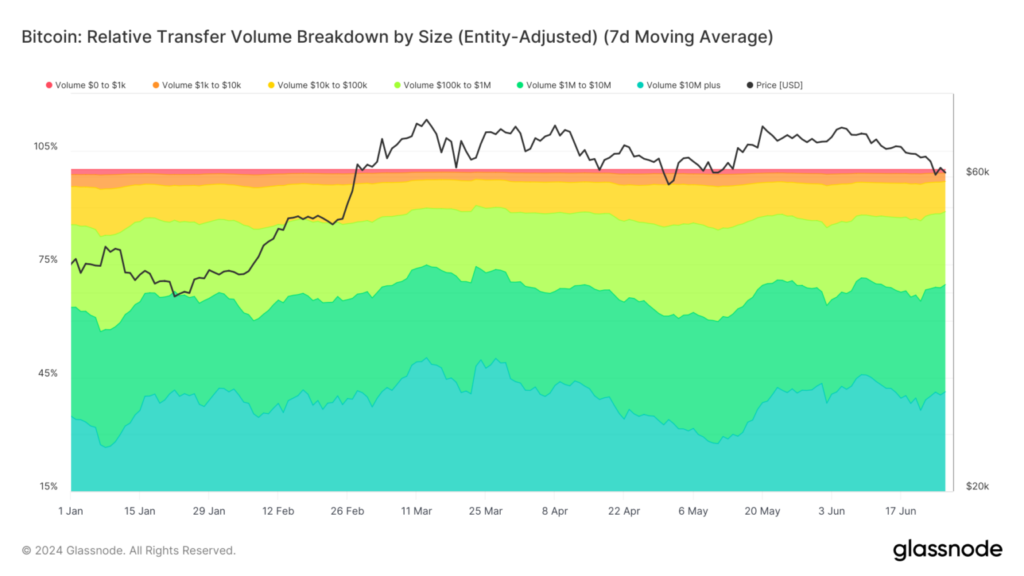

Bitcoin’s relative transfer volume, when adjusted by entity and categorized by transfer size, exhibits nuanced trends across varying transaction bands. In January 2024, transfers under $1,000 constituted a minor portion of overall activity. Notably, transactions between $1,000 and $10,000 experienced a slight increase, reflecting incremental retail participation.

Larger transfers, ranging from $10,000 to $100,000 and $100,000 to $1 million, demonstrated an increase, maintaining around 20-30 % of the total volume. This suggests an increase in institutional activity. Meanwhile, the $1 million to $10 million bracket also showed growth, while transfers over $10 million declined.

Between mid-January and April, volume over $10 million saw a resurgence before a decline, bottoming in May.

Levels for the largest transfers grew again in late May and have stabilized since. Other brackets moved relatively, with the exception of transfers under $100,000, which retained stability.

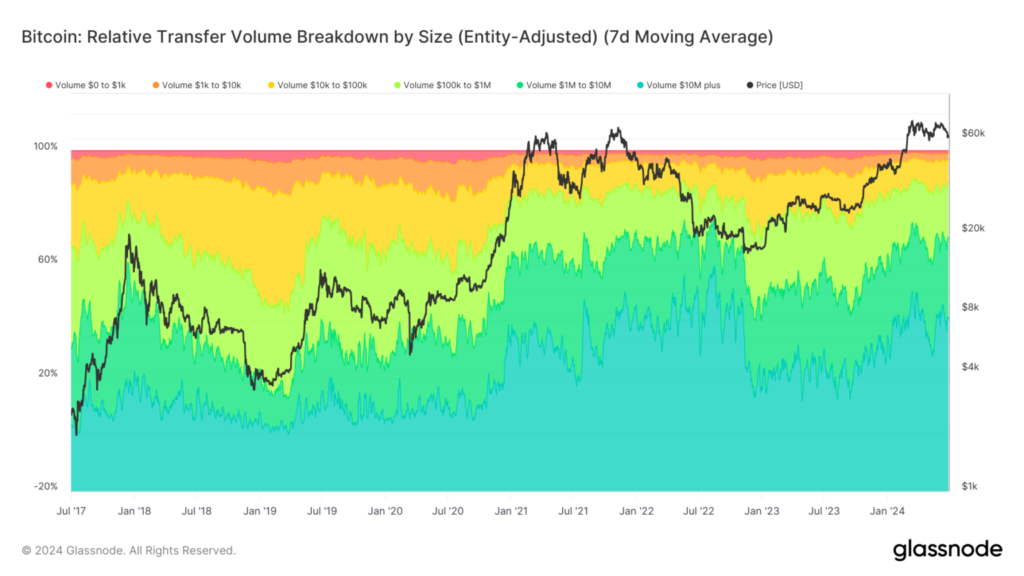

Compared with historical data since 2017, the past year has seen a reduction in the dominance of the smallest transactions, replaced by mid-sized volumes, especially those over $100,000. This shift highlights a maturation in Bitcoin’s user base, with a growing reliance on significant transactions, potentially aligning with the post-halving market conditions and a matured institutional footprint.

Source: CryptoSlate