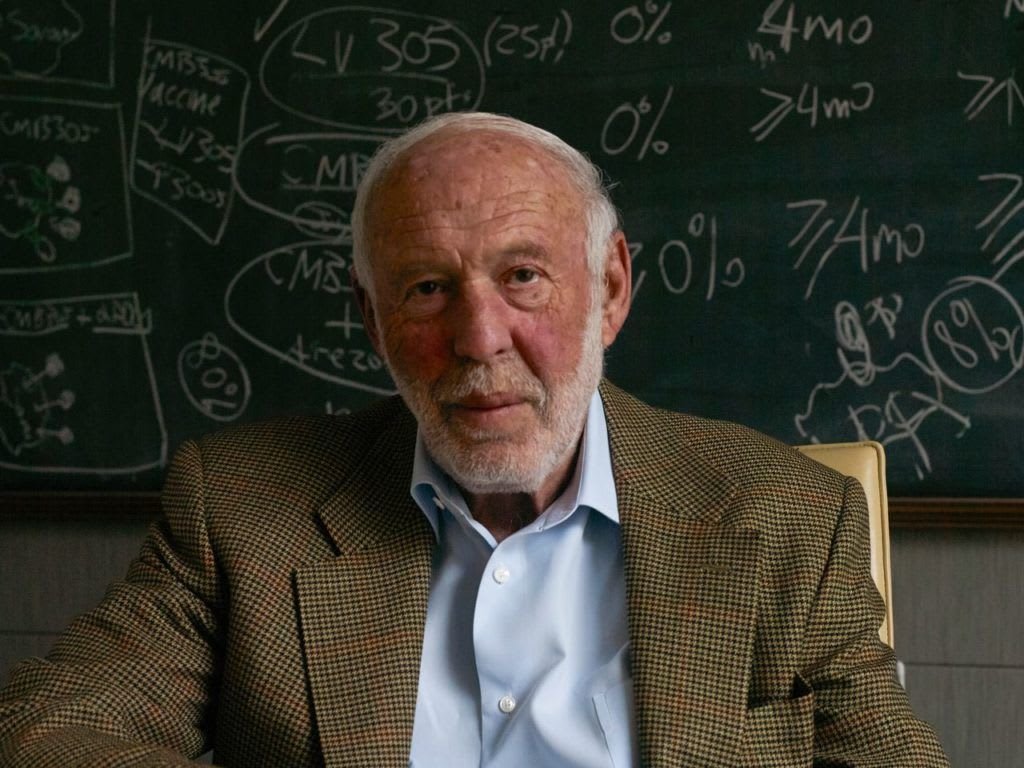

Jim Simons, a renowned mathematician, hedge fund manager, and philanthropist, left an indelible mark on the worlds of mathematics, finance, and philanthropy before his passing on May 10, 2024, at the age of 86. His legacy is multifaceted, reflecting his diverse interests and groundbreaking work in each of these fields.

Early Life and Academic Contributions

Born in Newton, Massachusetts, on April 25, 1938, Simons displayed an early affinity for mathematics, which would guide his academic and professional pursuits. He earned an undergraduate degree in mathematics from the Massachusetts Institute of Technology in 1958 and a doctorate in math from the University of California, Berkeley, in 1961. His work as a code breaker for the National Security Agency and his tenure as the head of the mathematics department at Stony Brook University were marked by significant contributions to the field of mathematics, including the development of the Chern-Simons theory.

Renaissance Technologies and the Medallion Fund

In 1978, Simons founded Renaissance Technologies, a hedge fund that became a pioneer in quantitative trading. The Medallion Fund, in particular, is renowned for its exceptional returns, significantly outperforming the market and earning Simons the nickname “Quant King.” Renaissance Technologies distinguished itself by employing mathematicians, physicists, and computer scientists to develop its trading algorithms, a practice that was revolutionary at the time.

Philanthropy and the Simons Foundation

Simons’ impact extended well beyond academia and finance into philanthropy. Alongside his wife, Marilyn Simons, he established the Simons Foundation in 1994, which supports scientific research worldwide. The foundation has made significant contributions to the understanding of autism, the origins of the universe, cellular biology, and computational science. Simons’ philanthropic efforts were driven by a desire to advance the frontiers of research in mathematics and the basic sciences, demonstrating his lifelong passion for these fields.

Leadership and Management Philosophy

Simons was also known for his unique leadership and management style. He emphasized the importance of hiring brilliant minds and fostering a collaborative environment at Renaissance Technologies. His approach to leadership was characterized by five guiding principles: embracing novelty, surrounding oneself with brilliance, pursuing excellence, persisting in the face of challenges, and cultivating optimism. These principles were not only pivotal to his success in finance but also reflected in his philanthropic endeavors.

Legacy and Impact

Jim Simons’ legacy is characterized by his profound contributions to mathematics, his revolutionary approach to finance, and his generous philanthropic efforts. His work has had a lasting impact on the fields he touched, inspiring future generations of mathematicians, investors, and philanthropists. Simons’ life exemplifies how a deep curiosity and a commitment to excellence can lead to transformative achievements across multiple domains. In summary, Jim Simons leaves behind a legacy that spans several fields, marked by groundbreaking contributions to mathematics, the creation of one of the most successful hedge funds in history, and significant philanthropic efforts aimed at advancing scientific research. His life’s work serves as a testament to the power of interdisciplinary thinking and the impact one individual can have on the world.